Taxes

In e-commerce, various taxes are applied when purchasing products, and these rates can differ by country. Bagisto allows you to create and manage taxes efficiently.

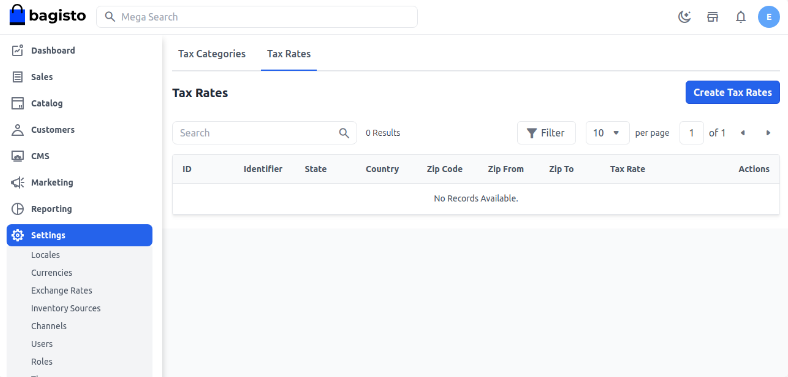

Tax Rate

Step 1: In the admin panel, go to Settings >> Taxes >> Tax Rates >> Create Tax Rate.

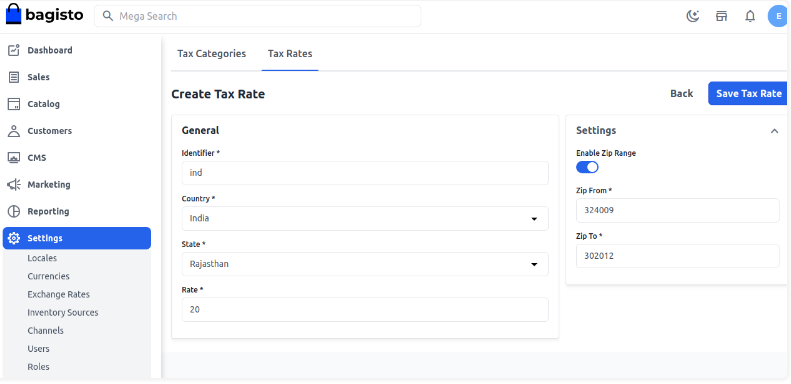

Step 2: Enter the following fields:

- Identifier

- Country

- State

- Zip Code

- Tax Rate

Note: You can also set a zip code range so that the tax applies only within that range. Then click Save Tax Rate.

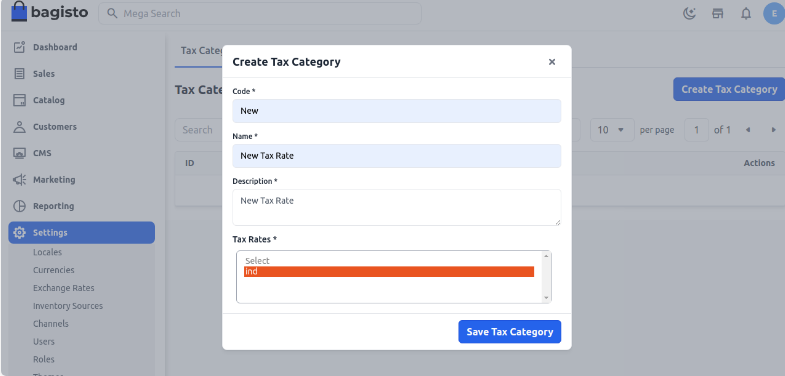

Tax Categories

Step 1: To create a Tax Category, go to Tax Categories.

Add the Fields

- Code: Enter a unique code for the tax category.

- Name: Enter the name of the tax category.

- Description: Enter a description.

- Tax Rate: Assign the tax rate.

Click Save Tax Category.

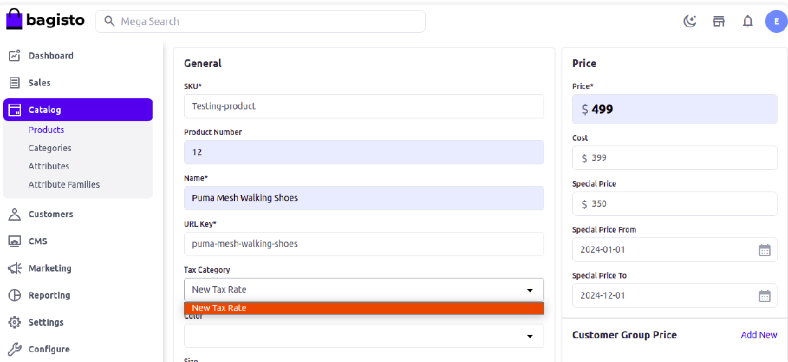

Step 2: Assign the Tax Category when creating a product.

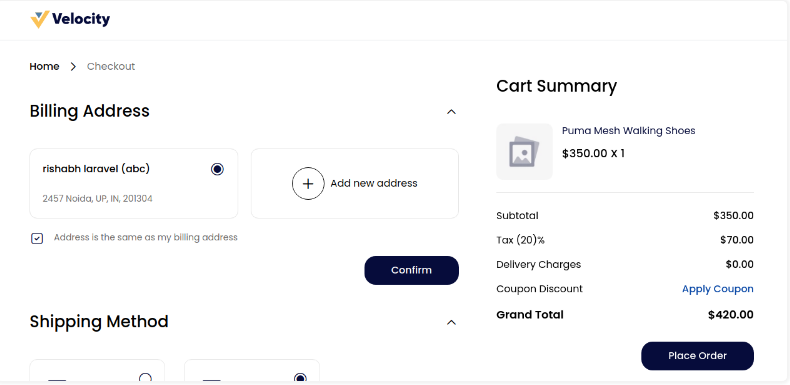

Frontend

Enter the billing address or sign in to your account and click Continue.

Select the Shipping and Payment methods and click Continue.

The tax will appear on the product price in the frontend. For example, if a 20% tax is set, it will be applied to the product price at checkout.

This is how you can easily create Taxes in Bagisto.