Taxes

A) Tax Categories

Tax categories are classifications for different types of taxes, such as sales tax, value-added tax, or excise tax, used to categorize and apply tax rates to products or services.

To configure, go to the Admin Panel and click on Configure >> Taxes.

B) Calculation Settings

Calculation settings define how product pricing and taxes are applied.

Calculation Based On

By default, there are 3 options for calculations: Shipping Address, Billing Address, Shipping Origin.

A) Shipping Address

A shipping address is the location where goods are sent for delivery, including recipient name, street, city, state, postal/ZIP code, etc.

B) Billing Address

A billing address is linked to the payment method and is used for verification.

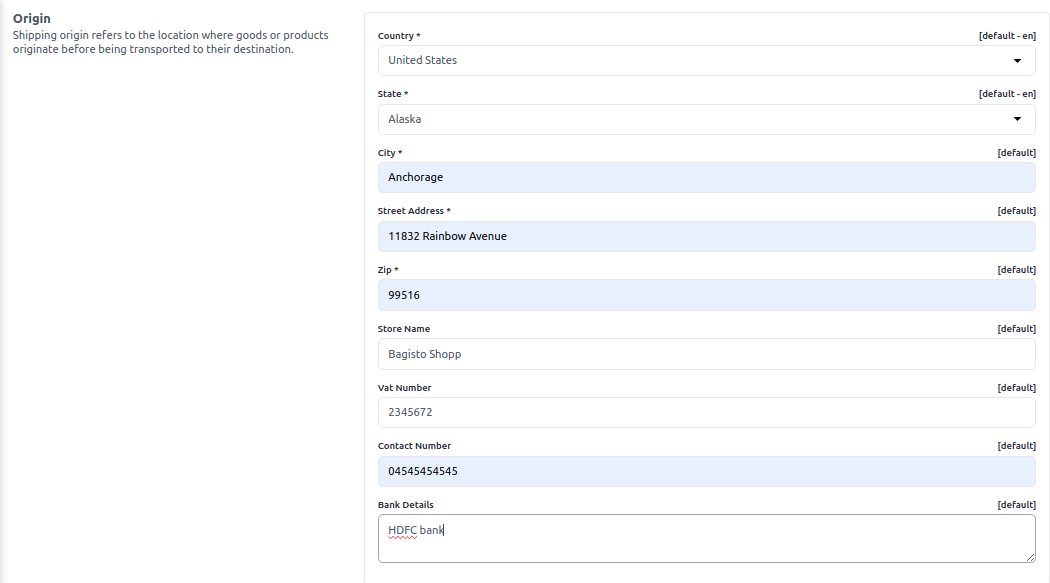

C) Shipping Origin

Shipping origin refers to the location from which products are dispatched.

This information is important for shipment tracking, calculating shipping costs, and estimating delivery times.

Product Pricing

You can select how taxes are included in product pricing:

A) Excluding Tax

No taxes are included in the product price.

B) Including Tax

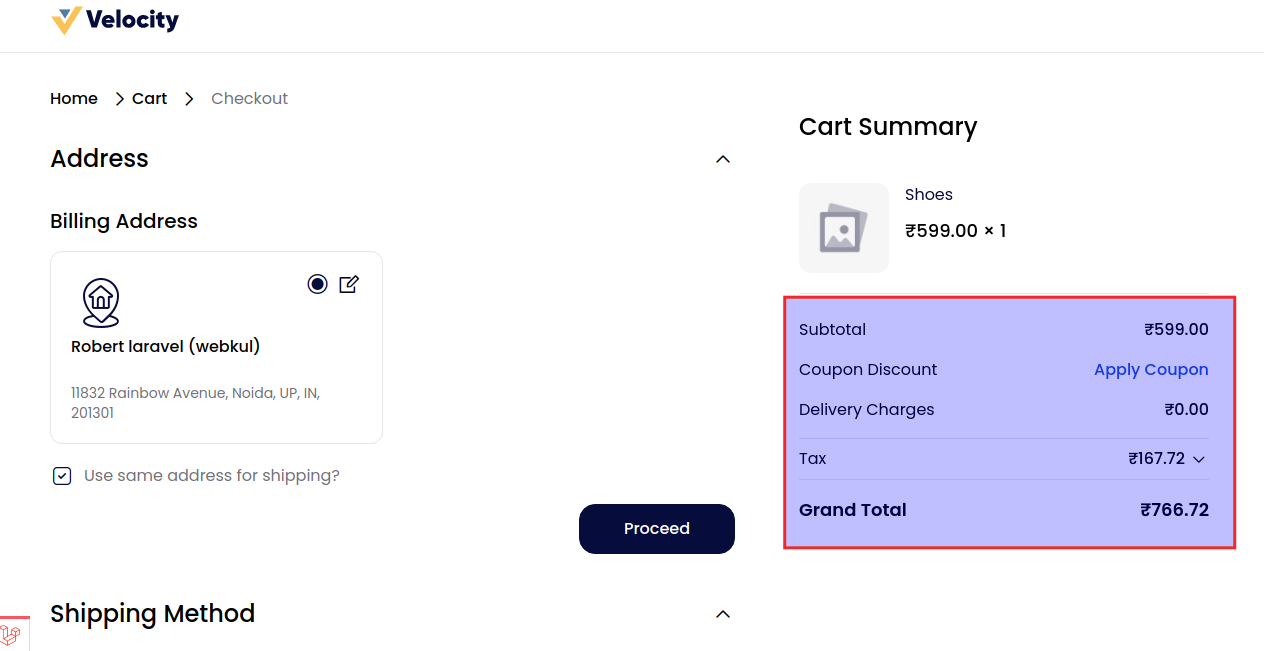

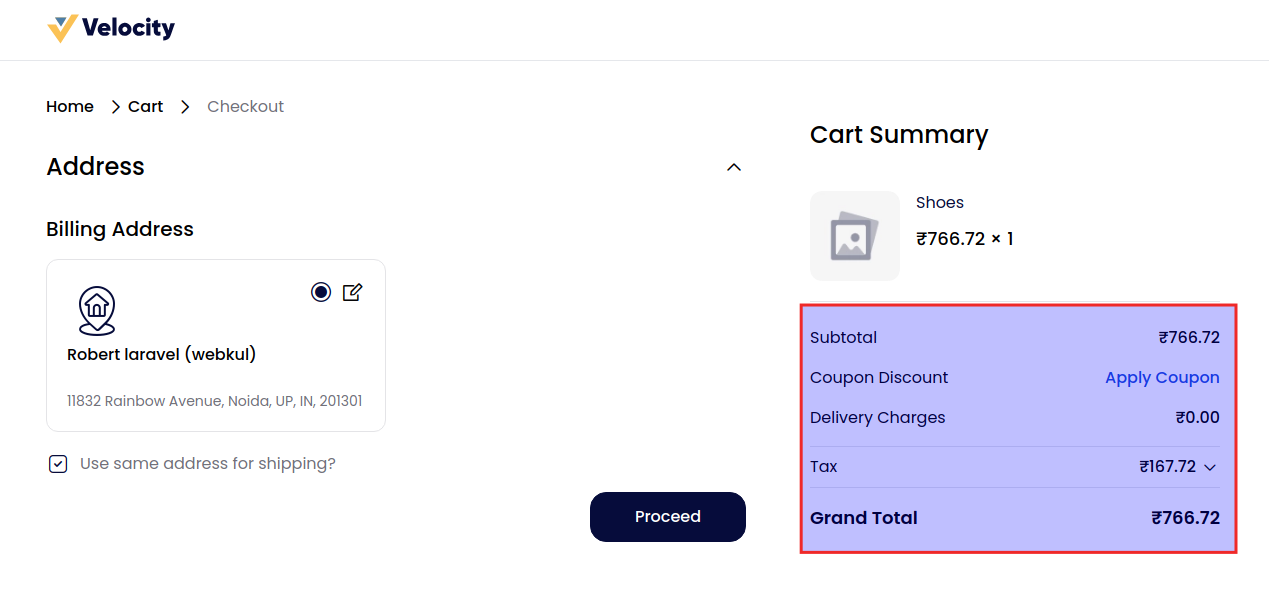

Taxes are already included in the product price.

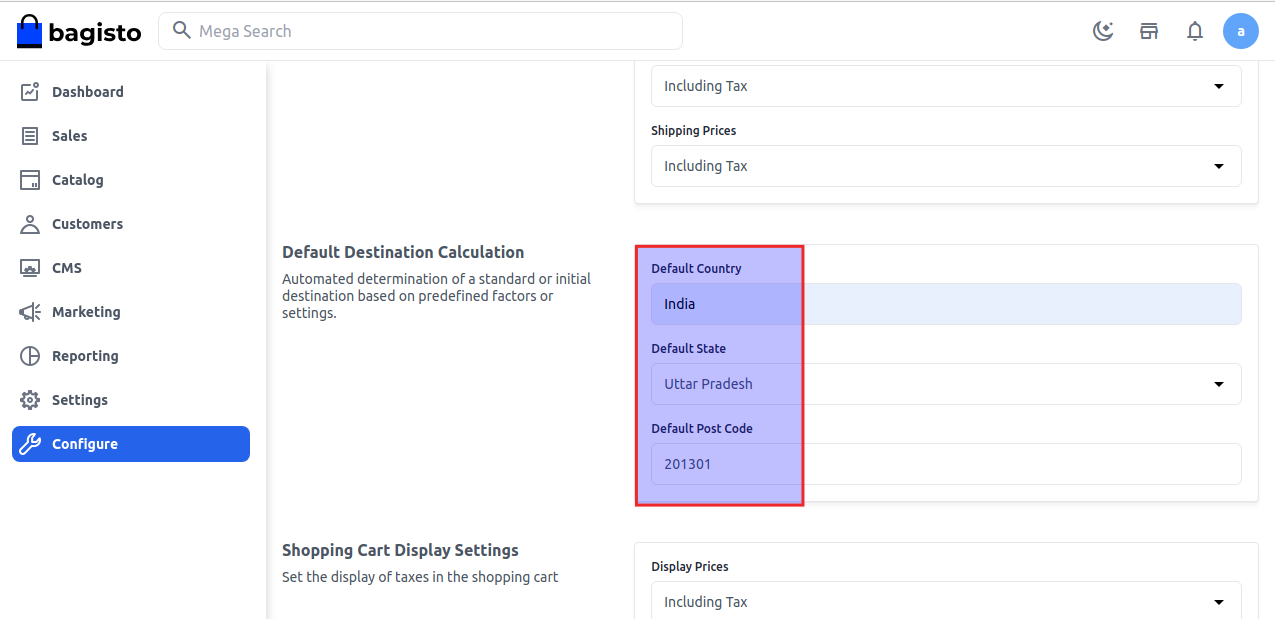

C) Default Destination Calculation

Select Country, State & Pin Code to automatically determine the shipping/delivery address.

Shopping Cart Display Settings

Controls how taxes are displayed in the shopping cart.

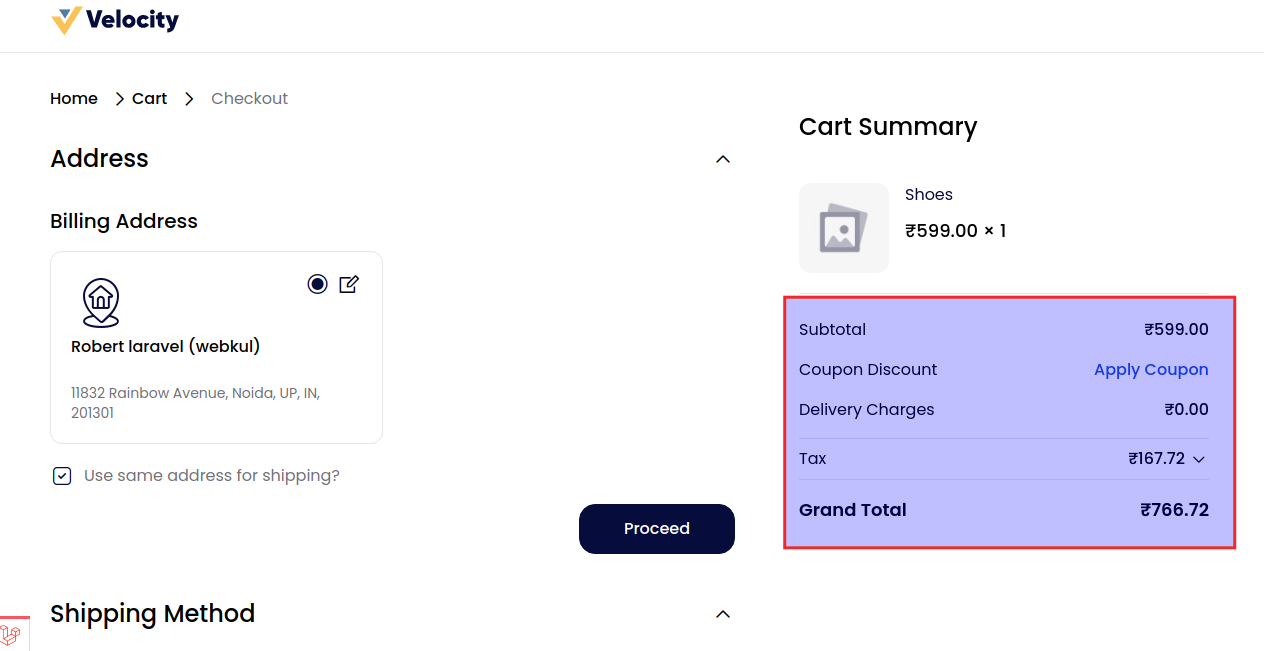

A) Excluding Tax

Taxes shown separately.

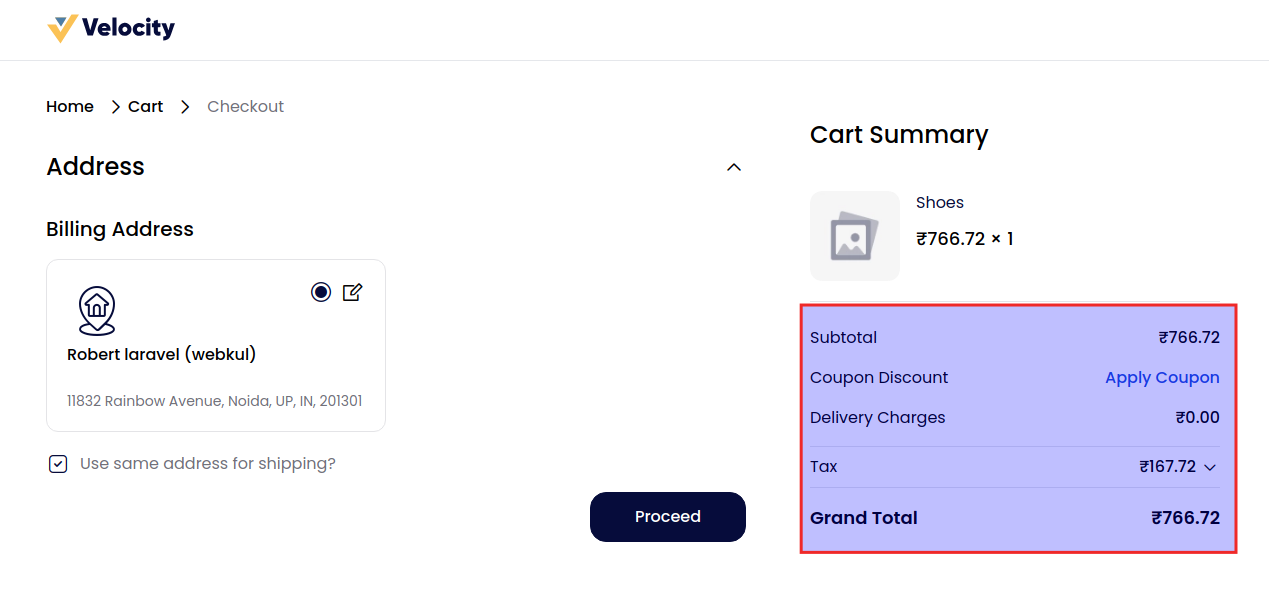

B) Including Tax

Taxes included in total.

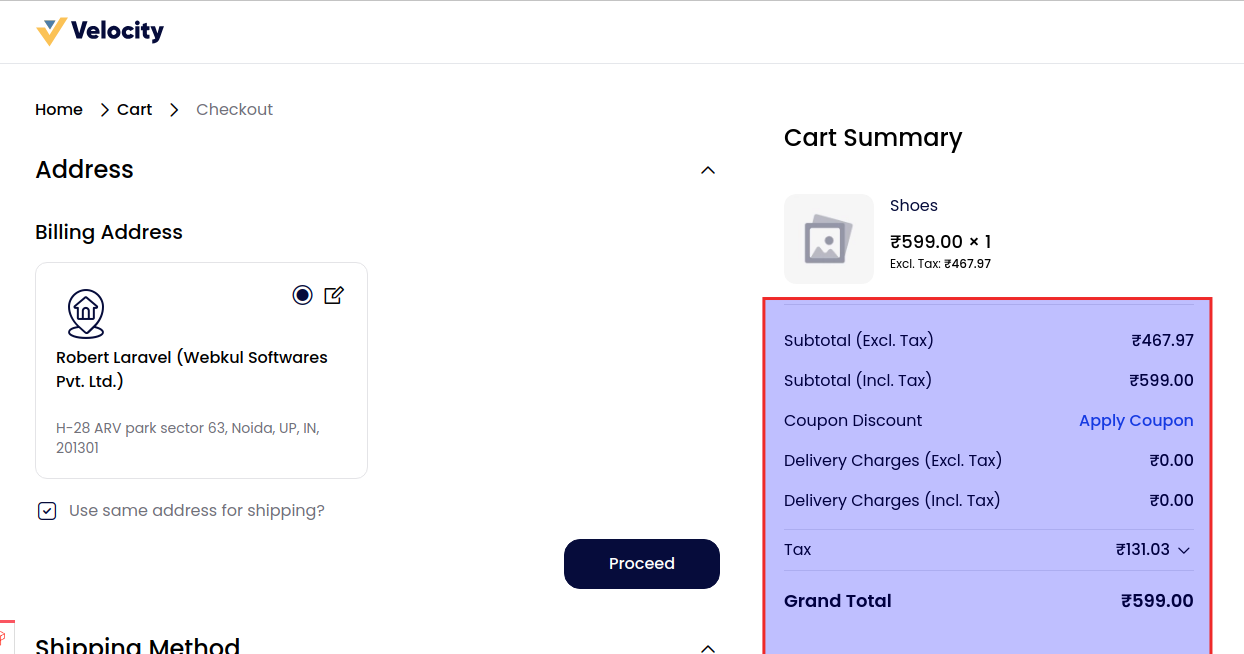

C) Excluding and Including Both

Shows both excluded and included tax amounts.